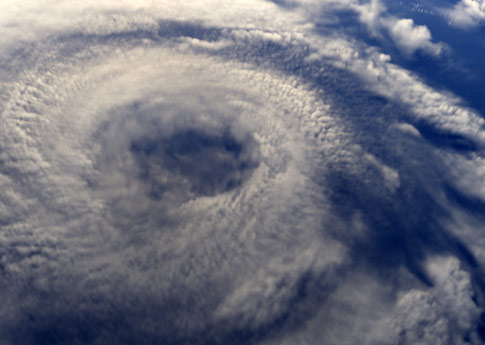

Natural disasters and travel insurance: what you need to know

If natural disasters such as hurricanes, tropical storms, earthquakes, and so forth were to occur before or during your trip, would you know what to do? If you had to be repatriated, or your trip was cut short, who would pay for it? Following are some questions you should ask yourself, or your insurer, before every trip, so you can leave with peace of mind—and no worries when it comes to your wallet either!

Before you leave

Can I predict the unpredictable?

The answer, of course, is no. Before you book a trip, however, you should always check that everything is in order in the country you want to visit. For example, if the federal government issues an advisory that warns against travel for a specific reason, few insurers will agree to cover you if you cancel your planned travel. Why? Because the situation that might prevent you from travelling, or prompt you to cut your trip short, is one that is known before you purchase your trip. Some insurers will even refuse to cover medical care required at destination, especially if it is related to the situation that led the government to issue its advisory.

Can I cancel my trip because of a natural disaster, like a hurricane?

Your Caribbean trip is booked and paid for. Then you see a news item about a natural disaster affecting the region you’ll be visiting. What do you do? Within 48 hours of hearing the news, contact your travel agent to find out what alternatives are available. Then—especially if those alternatives aren’t convenient for you—contact your insurer to open a claim file and confirm the conditions for reimbursement. If the only convenient solution for you is to cancel your trip, the insurer will expect you to do so promptly. The 48-hour time limit applies for most travel insurance contracts.

During the trip

Will my travel insurance cover the cost of my return flight in the event of a natural disaster?

Before you can consider filing a claim, you must be covered by a superior travel insurance product that includes trip interruption coverage—when you purchase your trip. This can be a private policy, your group insurance coverage, or the insurance included with your credit card.

If the event is unforeseeable, fortuitous and beyond your control, chances are you’ll be compensated. Pay careful attention to the list of risks covered, however. Check the exclusions and “coverage limitations,” which may reduce the reimbursement amount. Keep all invoices, and pay for as much as you can with a credit card, so that all of your expenses (e.g., living expenses, accommodation, transportation, meals, phone calls, Internet access) are traceable.

Can I be reimbursed for travel days lost as the result of a trip interruption?

Say you had two weeks left on a holiday in Europe, with several “non-refundable” reservations: hotel stays, excursions, etc. If you purchased trip interruption coverage, you may well be compensated for all expenses incurred for the portion of the trip you were unable to complete.

Crisis situations are often very difficult to manage. Make sure you can easily reach your insurer no matter what country you are in, and that it can recommend a hospital or doctor with a single phone call, guide you to the nearest embassy or consulate, pass on urgent messages to reassure your loved ones, and provide translation services if needed—you can never be too prepared!

Note that the Compensation Fund for Customers of Travel Agents may, in certain situations, reimburse some costs that are not covered by insurers. You should not, of course, expect a full refund, and your travel agency must hold a licence issued by the Office de la protection du consommateur du Québec (as CAA-Quebec’s 13 Travel Centres do).

Enjoy peace of mind on your travels

Discover your travel insurance options tailored to meet your needs.